By John San Filippo

According to FDIC and NCUA records, while U.S. banks have shuttered some 8,500 branches since the start of the pandemic, U.S. credit unions have opened nearly 1,000 branches. For any number of reasons, branch banking seems to be making a resurgence in the credit union space. However, while cybersecurity is understandably top of mind in this burgeoning digital age, the technology behind branch security has not changed much – until now. A company called Huvr and its monitoring platform OpticSense are looking to change the way credit union branches (or any physical location) are secured.

Patented Technology

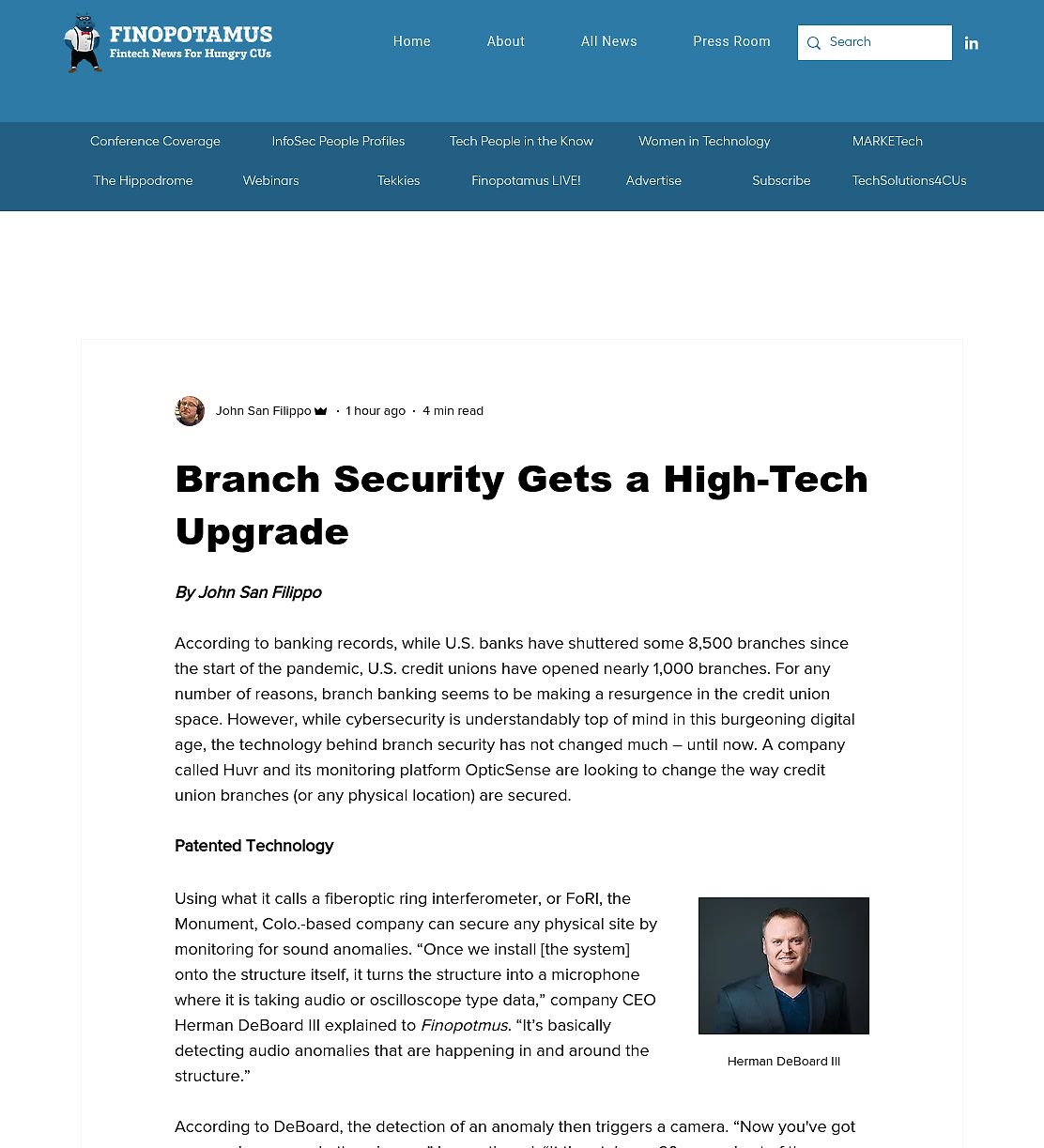

Using what it calls a fiberoptic ring interferometer, or FoRI, the Monument, Colo.-based company can secure any physical site by monitoring for sound anomalies. “Once we install [the system] onto the structure itself, it turns the structure into a microphone where it is taking audio or oscilloscope type data,” company CEO Herman DeBoard III explained to Finopotmus. “It’s basically detecting audio anomalies that are happening in and around the structure.”

According to DeBoard, the detection of an anomaly then triggers a camera. “Now you’ve got eyes and ears on what’s going on,” he continued. “It then takes a 60-second cut of the anomaly and sends it to an artificial intelligence server. That server takes about six seconds to do an analysis of all of the audio and video that it sees. And then it sends a textual analysis to security and/or police. It’s very, very fast and very, very efficient.” He added that the textual notification can include, for example, the color of a car or its license plate number.